Credit loans are a form of borrowing that you do not need to have collateral. With this form, financial institutions provide you with a credit limit that you can use for a certain period of time. However, like any other financial tool, credit loans also have their own advantages and disadvantages. In this article, we will explore these factors to better understand credit loans and whether it is a suitable option for your financial needs.

ADVANTAGES OF CREDIT LOANS

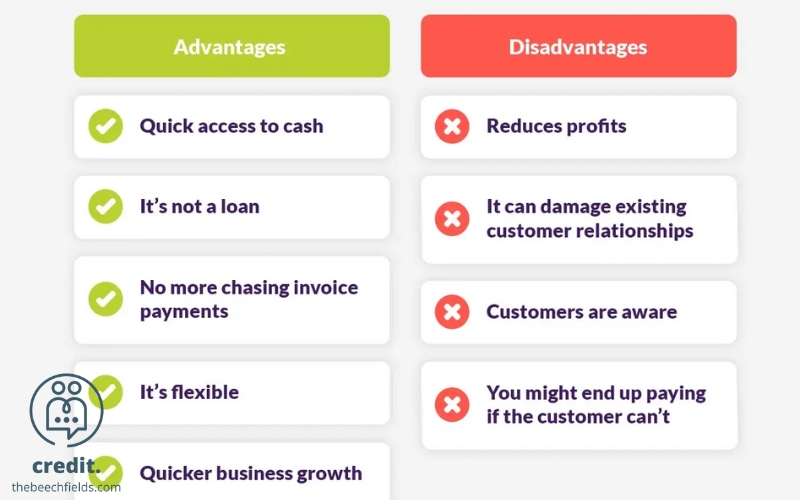

Credit loans bring many benefits to users if applied properly. Here are some of the main advantages of a personal loan:

1. NO COLLATERAL REQUIRED

One of the biggest advantages of a personal loan is that you don’t need to provide collateral, such as a home or car, to borrow money. This makes personal loans an ideal option for people who don’t have valuable assets to mortgage. Not requiring collateral reduces the risk for borrowers and opens up access to capital for a wider range of customers.

2. QUICK LOAN PROCEDURES

The personal loan process is usually quite simple and quick. You only need to provide some basic documents and meet the credit requirements of a bank or financial institution. If you qualify, loan approval and disbursement can be done very quickly, sometimes in just a few days. This is useful when you need money urgently, such as in an emergency or to cover urgent needs.

3. FLEXIBLE LOAN LIMIT

Credit loans often have flexible loan limits, suitable for each individual’s financial needs. You can borrow a small or large amount of money depending on your financial capacity and usage requirements. These loans can be used for many different purposes, from shopping, paying for education and medical needs, to investing in personal projects.

4. COMPETITIVE INTEREST RATES

Many credit institutions today offer quite competitive interest rates, helping borrowers save money compared to other forms of loans. In particular, for those with a good credit history, they can receive preferential interest rates and flexible loan terms. In addition, with long-term credit loan products, you can easily pay in installments every month without too much financial pressure.

5. BUILD A CREDIT HISTORY

Using and paying off credit on time will help you build and improve your personal credit score. This can make it easier for you to access future loans with better terms, including lower interest rates and higher credit limits. A good credit history can open up many financial opportunities in life.

DISADVANTAGES OF CREDIT LOANS

Although credit loans have many advantages, there are also many disadvantages that should be carefully considered before deciding to borrow money. Here are the disadvantages of credit loans:

1. HIGH INTEREST RATES

One of the major disadvantages of credit loans is that the interest rates can be quite high, especially when compared to other forms of loans such as mortgages or secured personal loans. If you do not pay your credit card balance on time, this interest can be added to your loan, increasing the total amount you have to pay. This can lead to a situation where you are in debt, especially if you do not control your credit usage.

2. RISK OF DEBT

When using credit cards, if you do not have a clear financial plan, you can easily fall into debt. Spending beyond your means or paying off your debts on time can lead to high interest rates and even additional penalties. Furthermore, if you borrow too much and do not repay your debts on time, you may have difficulty accessing other loans in the future.

3. UNSTABLE CREDIT LIMIT

Your credit limit may change over time, depending on your credit behavior and financial situation. If you use too much credit or fail to make payments on time, your lender may reduce your credit limit or even require you to pay it off immediately. This can make it difficult to get credit in the future.

4. BE AWARE OF HIDDEN FEES

Some credit institutions may impose hidden fees such as credit card maintenance fees, late payment fees, or international transaction fees. These fees can cause you to pay an unexpected amount, increasing the cost of borrowing. Therefore, before deciding to borrow credit, you need to carefully understand the fees and conditions attached to avoid unnecessary costs.

5. CAN AFFECT CREDIT SCORE

If you do not pay off credit loans in full on time, your credit score will be negatively affected. A low credit score not only reduces your ability to borrow in the future, but can also increase the interest rate when you borrow money. Therefore, not managing credit well can harm your credit history and affect future financial opportunities.

6. DIFFICULTIES IN PAYING OFF DEBT IN THE LONG TERM

Credit loans sometimes put you in a long-term financial burden. If you only pay a small portion of the loan amount each month, the amount you have to pay can last for many years. This will reduce your financial capacity, and can also affect other financial plans in the future.

CONCLUSION

The advantages and disadvantages of credit loans are things that need to be carefully considered before deciding to borrow money. Although credit loans bring many benefits such as no collateral required, quick loan procedures and the ability to build credit history, if not used properly, credit loans can also cause great risks such as high interest rates, debt and affecting credit scores. Therefore, before using credit loans, you need to build a reasonable financial plan, control spending and ensure on-time payments to avoid unwanted financial problems.